About The Commercial Real Estate Distressed Assets Association

History

CREDAA was founded in pre-launch in January of 2010 and was first developed starting on August 20th 2009.

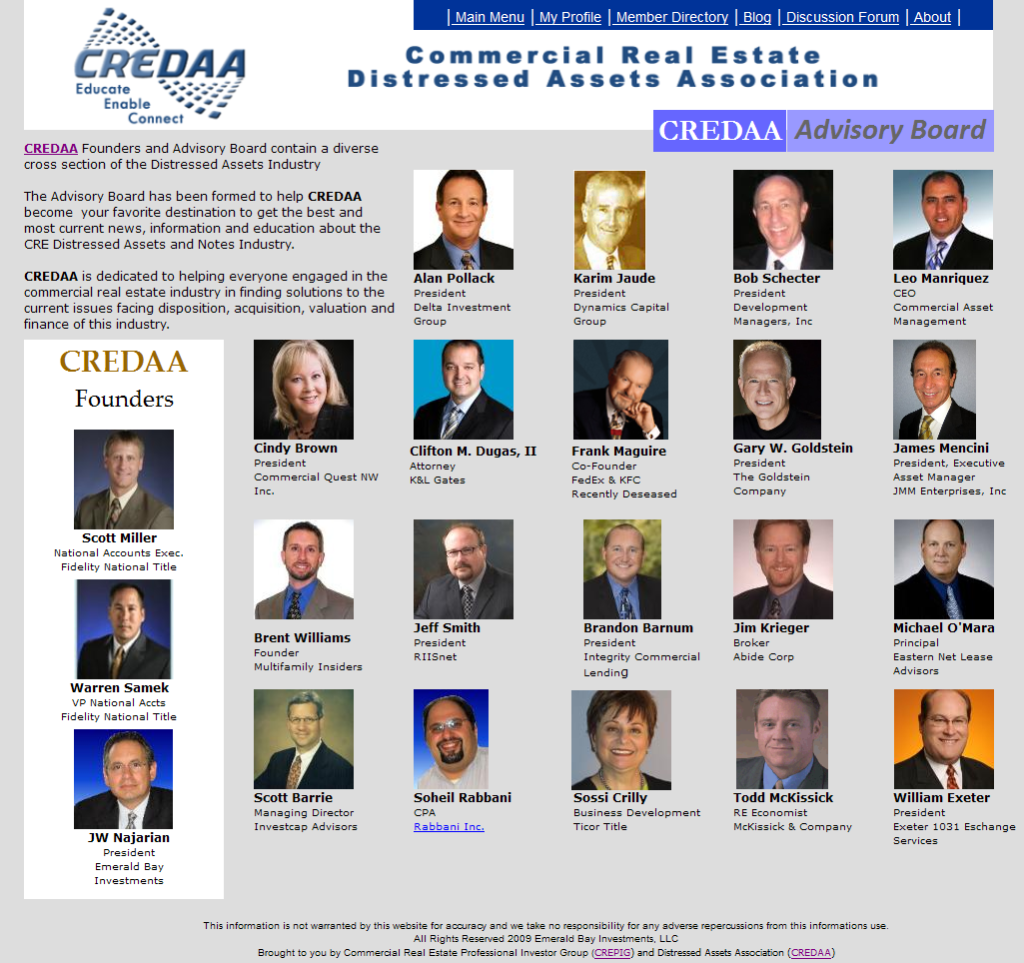

CREDAA is the brainchild of Scott Miller and Warren Samek, both National Commercial Account Executives with Fidelity National Title in Seattle, WA and JW Najarian, formally a commercial lender with Pathfinder Commercial Mortgage and the Founder of The Commercial Real Estate Professional Investor Group out of Los Angeles.

After the real estate and stock markets fell in September of 2008 the founders envisioned a commercial real estate collapse coming as the CRE market tends to lag just around 2 years from the residential market. We believe now that due to the magnitude of the market and residential market crashes, the commercial collapse is happening at a quicker pace.

Due to the TARP plan we believe the banks are holding troubled assets at an alarming rate and furthermore, that if these assets are held too long, that the market recovery will be much longer than it needs to be.

The founders came up with the idea that if the industry had a place to be able to work together at finding solutions, that the recovery could be sped up. The founders believe that an association of industry professionals and investors can, given the most current information, data and education, find and implement solutions that will help banks, brokers, lenders, investors and property owners re-work or get out from under troubled assets with the least losses.

Mission Statement

CREDAA is dedicated to, discovering solutions to the troubled assets market to help and guide in supporting, enlightening, educating and engaging our member base and the industry on the current state of Commercial Real Estate, Distressed, toxic, unstable, troubled Assets or Non-performing Notes, by using technology, seminars, lectures, symposiums, webinars, teleseminars, and other media to deliver high quality and pertinent industry news, views, content, analytics and analysis and education to legitimate investors, brokers, lenders, industry professionals and sellers to communicate, participate and work together in on-going daily forums. CREDAA will also provide professionals a forum to promote themselves by listing members and their services in order to allow other members to build professional teams nationally to get projects moving.

Vision Statement

CREDAA, as an association, will be a powerful information resource and community for the commercial real estate and financial industry. CREDAA will effect positive change. Employing our mission to support and educate the industry to help find win-win solutions for financial institutions, lenders, brokers, buyers and other professionals can use and utilize to help move these assets into the public realm. As a group, we will assist the economy by turning around our current bad debt in Commercial Real Estate markets.

Goals

To provide brokers, lenders, banks, investors and other CRE industry professionals, education, solutions, resources and other support to help them in the disposition, acquisition, valuation and financing of CRE Distressed, Toxic, Unstable or troubled assets and non-performing notes. Become a membership of companies and individuals operating in the commercial real estate, investment, finance, and banking industries.

Policies and Procedures

CREDAA is a professional organization dedicated to the aquisition or distribution of commercial distressed assets and notes.

Values Statement

CREDAA believes that integrity of a person can only be determined via the values one possesses in a particular order. To stay in integrity CREDAA will judge each situation against this value list in this particular order.

- Customer Service

- Value product / user

- Ease of Use

- Profitable

NEW CREDAA

In July of 2011 Leonard Mangriquez of ALB Commercial Capital took over the reigns of CREDAA taking the focus off of CREDAA Connect and placing it at www.CREDAA.com. This change added needed functionality and added high level CRE industry training.

ALB Commercial still runs the www.CREDAA.com site, but has decided to focus on the lending side of the industry.

Sadly CREDAA Connect has been taken down. Here is what I saved from the front page of CREDAA Connect.

CREDAA, is dedicated to discovering and creating solutions for the Commercial Mortgage default industry and work towards keeping our members at the forefront of industry news and views, and provide support in the professional development and advancement of our members.

| 1. Educate |

|

With CREDAA, members leverage the power of knowledge and the brilliance of other industry professionals to enable success in the current CRE marketplace. CREDAA delivers education utilizing a variety of platforms like audio & video podcasts, webinars, seminars, online training, and Summit educational conferences.

|

| 2. Enable |

|

Navigating, seizing and controlling current markets can only be accomplished by leveraging the latest research, analytics, news, and views. CREDAA is a place that provides access and the ability to find essential resources to enable the member to find and complete deals in an extremely tough market.

|

| 3. Connect |

| Real solutions through collaboration found only with the power of CREDAA networking. Find your local and national deal teams with the best of the best in the industry. Participate in business building events where you learn, find deals, make contacts, and create valuable friendships. |

Closing Letter to CREDAA Connect Members

Hello members of CREDAA Connect. In August of 2009 a group of users from The Commercial Real Estate Professionals and Investors Group CREPIG.com got together to start a site that would help tie investors to distressed commercial properties.

We had high hopes, but as most of you know, at that time it was impossible to find any inventory that penciled out for investors and the banks were holding or should I say hoarding most of the marketable inventory.

With advisory board members like the late Frank Maguire Co-Founder of FedEx & KFC and many others (see http://onpurposemagazine.com/2014/04/11/the-commercial-real-estate-distressed-assets-association-credaa-story-2009-to-2011/) we worked hard to blaze new trails in an ailing industry.

This proved to be an almost impossible task as the banks would not release inventory or funds.

In 2011 Leonard Manriquez of ALB Commercial Capital took over the site which worked to educate, enable and help connect the thousands of investors, property owners and brokers with a site that allowed first class networking, resource development and education. You can still go to www.CREDAA.com to check out the work that was done there. Leo did a great job, but the industry was still taking a beating and ALB Commercial Capital has decided to make their priority lending in the commercial and multifamily markets.

To this end CREDAA Connect is shutting down. We appreciate our members and hope that you will check out www.ALBCommercialCapital.com for all your commercial finance needs. You may also join thousands of other CRE networkers at www.CREPIG.com with over 5000 members or at CREPIG at Linkedin with over 19,000 members at https://www.linkedin.com/groups/CREPIG-Commercial-Real-Estate-Professionals-79765 or CREPIG at Twitter www.Twitter.com/CREPIGsite which has over 36,000 followers.

Regards,

JW Najarian

Metta Media Group

www.OnPurposeMagazine.com

www.CREPIG.com

US Veteran Group Linkedin

Watch this Video on A Better Way To Fight Harmful Free Radicals

Watch this Video on A Better Way To Fight Harmful Free Radicals

Even though the commercial real estate collapse did not occur as much as experts expected, it is important to protect the market with such initiatives such as CREDAA to make sure this is not going to be repeated again!