Bidding Is Closed.

Bidding Is Closed.

CREPIG, once one of the largest private CRE websites is offering it’s websites and social media clout to the commercial real estate industry.

NOTE: Information may have changed since you last looked at this page. Please go to the offer section and re-read if you have not done so in the last 8 hours. To go to offer click here

What is CREPIG

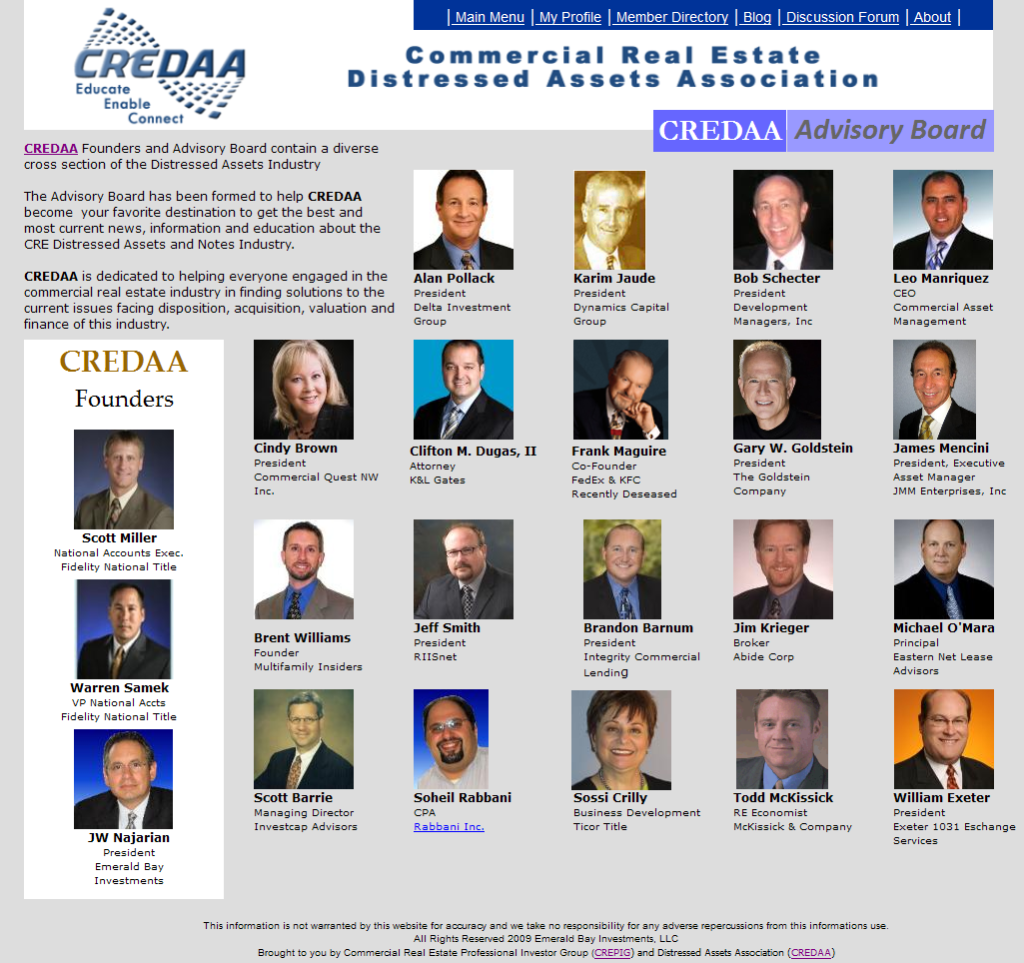

Hello, my name is JW Najarian and I am the founder and creator of On Purpose Magazine and the Commercial Real Estate Professional and Investor Group (CREPIG) site. It has been a wonderful run. We started CREPIG in October of 2008 officially. It was open a bit earlier to a smaller group of Commercial Real Estate (CRE) professionals.

The site was initially created to help an ailing industry. The economic crash in 2006/7 crippled the industry severely and CREPIG was formed to try to get the industry back on it’s feet by providing information we believed necessary to help out many struggling CRE professionals, after the market crash.

I did interviews with the top CRE execs and world class economists and heads of banks to try and figure out how to move ahead in a world where money went from being easy to becoming almost impossible to get.

I did interviews with the top CRE execs and world class economists and heads of banks to try and figure out how to move ahead in a world where money went from being easy to becoming almost impossible to get.

I talked with hard money lenders and so many others and at some point realized that the market would take more time than we first thought, to come back.

I talked with hard money lenders and so many others and at some point realized that the market would take more time than we first thought, to come back.

CREPIG grew quickly and became one of the top 10 CRE sites nationally, we competed with several sites and although we never reached numbers like Loopnet, we did do very well.

CREPIG grew quickly and became one of the top 10 CRE sites nationally, we competed with several sites and although we never reached numbers like Loopnet, we did do very well.

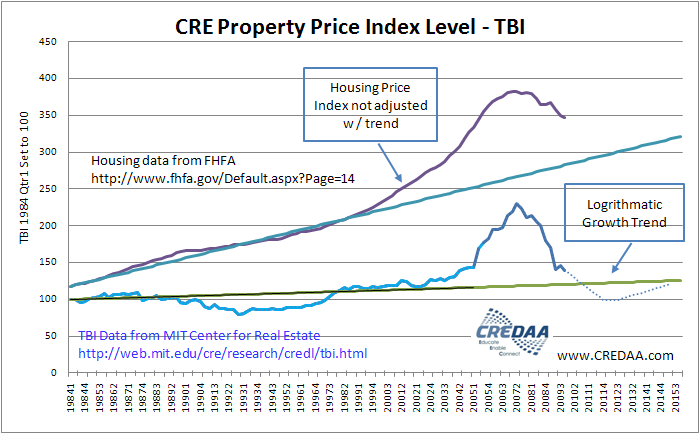

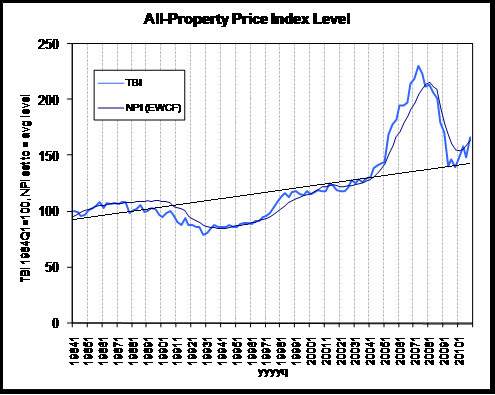

I published news and articles and did graphs based on MIT / Moody studies that showed that the trends ahead for commercial properties were not going to be as they were in the past. Since 1985 there was a steady growth in CRE of around 8% growth year over year, till the crash and all the new studies showed only a 3% growth rate for the next 15 to 20 years.

At that point I made CREPIG into a site where you could post your deals and these deals were shared with the 5000+ on this site, plus an additional 40,000 across CRE social media.

At that point I made CREPIG into a site where you could post your deals and these deals were shared with the 5000+ on this site, plus an additional 40,000 across CRE social media.

The social technology companies like Twitter and Linkedin have changed policies as to slow down and even stop the auto posting of the forum here to other forums.

I have paid hundreds a year to keep this open and free for you the CRE public, but I came down with stage IV cancer and have had to stop spending time I did not have on providing free services to an industry that barely uses them.

I have paid hundreds a year to keep this open and free for you the CRE public, but I came down with stage IV cancer and have had to stop spending time I did not have on providing free services to an industry that barely uses them.

I did help co-author a cancer book Cancer: From Tears to Triumph and it went #1 Bestseller in the US, Canada and Australia in the first week of publication which allowed us to give over $25,000 to a children’s cancer fund.

Click Here to Order From Amazon

It allowed me to tell my story and help cancer patients, family members, friends and caregivers see the gifts and positive side of the challenges and tragedies associated with this terrible disease.

My digital art, featured at www.ArtQuench.com Gallery, Magazine and Coffee Table Art Book Series and is being received well. So I am not down and out, but do need to stop paying for CREPIG and let it go to someone who has the capability to do something with the foundation I have laid over the years.

I have met and spent a lot of time with many of you and I have to say we had a great family of CRE pros at CREPIG and it’s other social media proponents. I have grown to know, work with and care for so many of you, but it is over for me now and I just want to thank all of you and wish you the best going forward.

I want to thank my incredible staff of volunteers for all their selfless work and support for CREPIG and me. So thank you Bob Schecter, Sossi Crilly, Beth Ann Grib and Bill Evans

If you have the right stuff and want to run this site. Call me at 818-353-9100 and listen to the message to find out how to make an offer. I will consider all offers. I will be shutting down the site in January one way or the other.

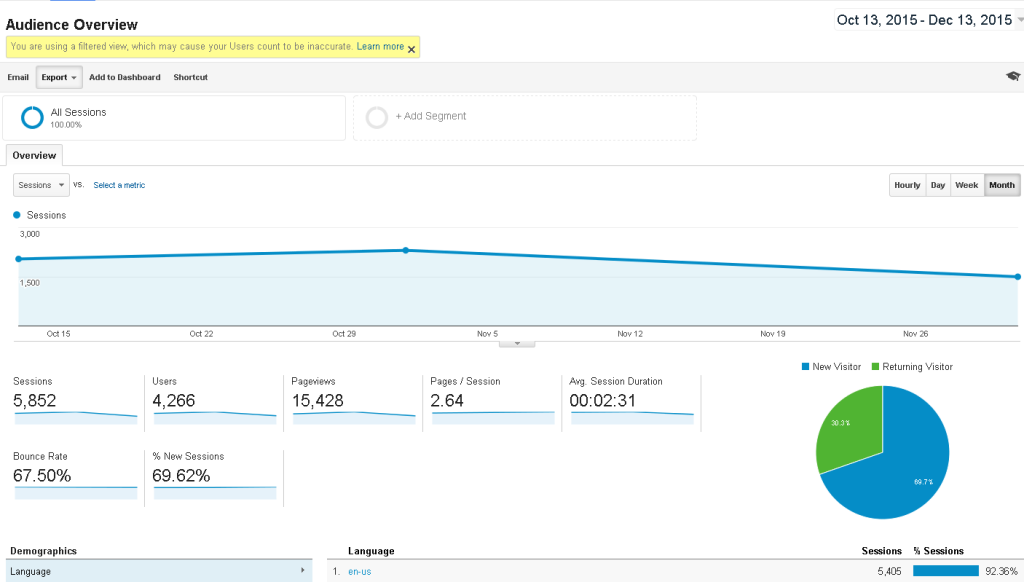

Many have asked what the current traffic is like. I do not consider this a selling point as no one has promoted the site for over 2 years, but the numbers are actually good for a site that I do very little work on.

The forum keeps chugging along and so we continue to get fair traffic relatively, but remember the offer is not for traffic. It is for the site and all the other social media Super Groups and the ability to use those platforms to grow your business or to use as a foundation to start a new business. Here are the current stats.

Notice Unique visitors is rather large, which is good. Would like to have a smaller bounce rate, but everyone that visits seems to spend on average just under 3 minutes, looks at just under 3 pages and so without any moderation the site still gets over 15,000 pageviews. The right person could take this back to the previous numbers or more in no time.

Here is what I am offering

As the founder and creator of the CREPIG site www.CREPIG.com the Linkedin Groups and the Twitter Group associated with CREPIG I would like to offer the following.

What you get

- CREPIG Site (as is) with a cost of $24.95 a month that the new owner will take over in January 2016. The site has 5600+ members with full contact info. NO SALE OF MEMBER LIST outside this deal.

- Twitter CREPIG Accounts @CREPIGsite 43,600 and @RREPIG 35,700 Followers ~ Total 75,000+ Followers

- Linkedin CREPIG Group 21,700+ RE Professional Investor Group with 2400+, RE Open Networker / Investor 2000+ Members for a Real Estate Total of 25,000+ Members.

- CREPIG.com URL which you will pay for after transfer and CREPIG Site is on a Ning platform and costs $24.95 a month to maintain (not counting your or your IT departments time)

- (NEW) Facebook CREPIG Page with over 800 members

- So in Total of over 111,000+ Real Estate Followers and/or Members

If you are not sure if the lists of CRE Professionals and Investors is real or useful, just know that it reached you! That has to mean something. 🙂

What I am looking for:

I am looking to make the best deal possible.

I am putting the CREPIG site, social media and the brand up for bid. In a perfect world I would like to receive a dollar amount and a percentage of any profit going forward. That is not necessary, however. I will take just a dollar amount, but keep in mind, best deal wins.

Also know that whether or not I get a percentage of profits going forward, I will not be able to work with your staff at no cost. If I am needed for technical issues (transfer of URL and sites not included. I will help to make transfer as smooth as possible.) I will ask for an additional $80 per hour with a minimum of a one half hour per session.

Note that because of my health condition, I may not be able to help, but I do have a partner that can help with all realms technical including porting over to new platform etc., so you will never be left out in the cold if you or your team need technical help with the new sites and apps.

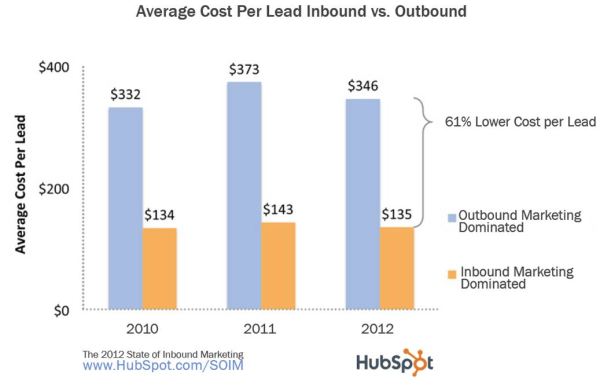

This is a FIRE SALE. The average cost of a single lead is very expensive out on the open market. Depending on whether you will be pursuing an inbound or outbound marketing strategy here is what you will pay, on average for a good lead according to Hubspot, the leader in Internet and Social Media Marketing Research.

What is CREPIG Worth?

Using these numbers and taking CREPIG leads, depending on your promotional strategy, at their worst, these are the numbers I should be asking for.

111,000 / 2 = roughly 50,000 (figuring for dupes)

50,000 / 2 = 25,000 (figuring for worthless leads)

25,000 / 2 = roughly 12,000 leads (figuring for good leads that go no where)12,000 / 4 = 3,000 leads (just to make sure I am fair)

So let’s figure 1110 leads are solid sales (That is 1% of the leads offered)

1110 x Inbound Lead Amount (Most of the people I have spoken to will use Outbound Marketing techniques with my members and followers) of $135

This equals a lead cost of hundreds of thousands

Now to be ultra fair take the 5,000 members I have at CREPIG.com and say that only 50 of the names are useful leads. The math would look like this 50 x $135 = $6750.00 or 50 x $346.00 = $17,000

So worst case the site is worth close to $7,000. To the right person this site and it’s associated groups is a goldmine if used properly. I have checked these amounts with Internet marketers and car dealers and they are similar. Check out Driving Sales Forum, Hubspot, The Marketing Sherpa and many other forums and sales organizations.

If you Google Commercial Real Estate Leads you will find one company that charges $35.00 per lead. Then you find that the company has a Ripoff Report as they do not provide sales ready leads. Are there good leads under $135 each? I do not know, but I haven’t found any. Have fun.

How Do I Make An Offer?

I am starting the bidding right now. The bidding process will end on December 15th at midnight – Pacific Time. I am asking for 50% on sale and other 50% on delivery. All sites, social apps and Linkedin Groups will be transferred as is and the sale will be final.

Update: I will post the latest bids on December 13th so that everyone has a chance to counter offer. The post will be on this page only.

I will not part out the different platforms separately. The bid and sale will be for all that is listed above. No more or less.

I was following a discussion in chat area on the member site Networkers United Worldwide

I was following a discussion in chat area on the member site Networkers United Worldwide

Watch this Video on A Better Way To Fight Harmful Free Radicals

Watch this Video on A Better Way To Fight Harmful Free Radicals