Chicago is not setting the pace for building a solid Platform for Commerce and regional economic innovation for job creation. Then again, neither is Illinois. They are both caught up in a Vortex of Declining Mediocrity.”

You know your state is really messed up when all your relatives start talking about moving to other states. At a recent family gathering, one cousin and a brother-in-law are talking about moving to Florida, another one to Las Vegas and another one to Idaho. Even the waitress at breakfast at Denny’s was talking about moving to Las Vegas for better opportunities. Is anyone staying in Illinois?

It may be because Illinois is bankrupt from a creativity and innovative standpoint. The only innovation I see is the amount of taxes and fines they can levy in order to try to balance their bloated budgets and patronage-heavy payrolls.

It may be because Illinois is bankrupt from a creativity and innovative standpoint. The only innovation I see is the amount of taxes and fines they can levy in order to try to balance their bloated budgets and patronage-heavy payrolls.

From red-light cameras to speed cameras, certain Chicago neighborhoods are looked at as revenue generators for traffic fines while others claim the fame of being more dangerous than Iraq. (Hence, the nickname Chiraq)

Now, those traffic fines generated by the red-light cameras are being questioned for their validity. Chicago may have to pay back a lot of those “Sheriff of Nottingham” fines.

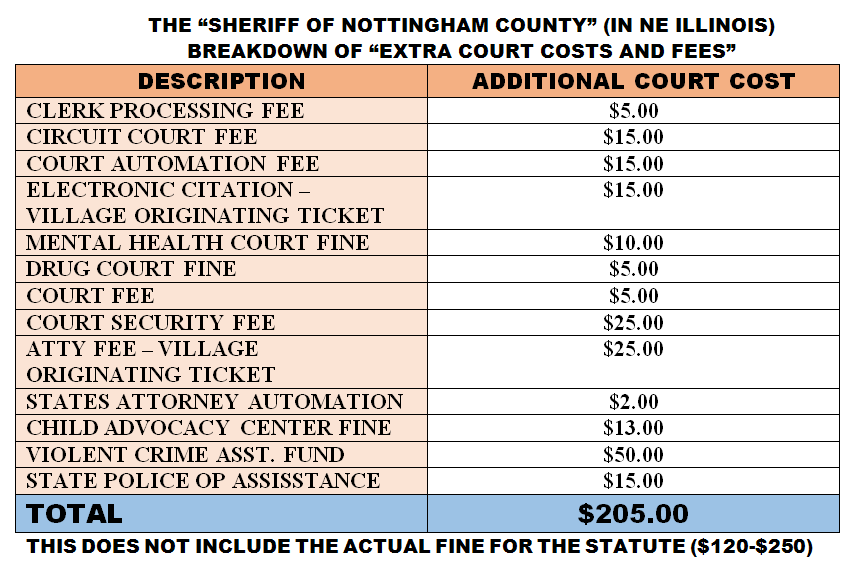

In another part of northeastern Illinois, the county cannot seem to fund different services for its constituents so what they have done is load up fees as part of the “court costs” for traffic court. Talk about living in the County of the Sheriff of Nottingham, this county depends on revenues generated from additional fees tacked on to misdemeanor traffic tickets which have no tie-in or correlation to the violation itself. I was told other counties are similar in their gouging on mundane traffic violations.

When you look at the breakdown of “court costs” you wonder how they have tacked on so many other non-related issues? It shows that after creating a budget, they had to go back and figure out how to fund other areas that they shortchanged.

On a minor traffic ticket, why should you be paying for mental health, violent crime assistance fund or child advocacy funds? That’s an extra $73 that has zero correlation to the ticket itself. Maybe those ticketed should charge a “guest appearance fee” to the court to offset all these extra charges.

PROPOSED SOLUTIONS ARE LAUGHABLE

Instead of looking for real solutions to funding problems or cutting costs, agencies within the state try to tack on more fees to shore up under-budgeted items which should be reviewed and maybe reduced.

The president of the Chicago Teachers Union, Karen Lewis, talks about supporting a proposal to tax any suburbanite who works in the city a one percent income tax in order to shore up insolvent pensions. (We know how that goes. This year, it’s one percent. Next year, it’s three percent. The third year, it’s five percent to cover everyone’s 10% Christmas bonus and extra week off.)

First of all, that’s taxation without representation. If the suburbanites can vote who will be mayor of Chicago and also have representation on the City Council, then the idea would have some validity. Commuters already pay enough in commuting fees and everyday expenses, like lunch and any shopping they do downtown.

Second, the city has to do some real belt-tightening before they try to reach out to commuters for more money. They already have the second highest sales tax in the country (9.25%). Chicago gas prices are also $.53 higher than the national average. (http://www.illinoispolicy.org/chicago-gas-prices-0-53-higher-than-national-average/ ) Where do all those extra tax revenues go?

Every time someone eats at a restaurant, gets gas, or goes shopping downtown the city is getting tax revenues. The size of the City Council (50 Aldermen) could be cut down in half and still be bloated compared to the size of City Councils in New York and Los Angeles. All the savings on their salaries, benefits, staffs, and multi-million dollar ward funds could make a significant dent on covering other city financial obligations including insolvent pension balances and putting more police on the streets.

Third, the Teachers Union should be more worried about the quality of product they produce out of the Chicago Public Schools. With a dropout rate over 40% and those who reach high school graduation at less than 64%, no platinum benefits should be awarded to those doing less than a mediocre job.

The Chicago media is also to blame for its failure to report the real issues going on in Chicago and Illinois. More people get the important stories by reading an unofficial police blog, than they do watching the 5 o’clock news or reading the papers. (www.secondcitycop.blogspot.com )

It is funny when a big story breaks, the police blog has it first and the papers and TV media scramble to publish it because it is too big to hide and they look foolish when they miss reporting the story or come in with the story two days later.

Too many reporters act more like starstruck cheerleaders for some of the politicians, instead of hard-hitting, objective journalists, but that’s another story. Others, seem to let the police blog uncover a story and then that becomes the reporter’s column for the day.

THE ILLINOIS 500

Is that a new race on the NASCAR circuit? No, it’s the number of private sector jobs Illinois created in the last nine months (August 2013- May 2014). That is one job for every 300 high school seniors. (http://www.nationalreview.com/corner/381687/illinois-created-500-private-sector-jobs-9-months-andrew-johnson )

Chicago and Illinois political, civic, and media leaders need to wake up to the realities of the 21st century. You cannot apply 19th and 20th century solutions (Horse-and-buggy taxes and fines) to 21st century problems. You also cannot hide the problems because in today’s Internet age, someone is going to report the news and you look foolish and very unprofessional trying to suppress it.

With large corporations like Walgreen’s and Abbott Labs seriously thinking about moving out-of-state (and actually out-of-country), it’s time to re-think obsolete economic development strategies. Government needs to become creative and innovative on how they grow the tax base, instead of killing it with an overabundance of taxes and fees.

The infrastructure needs to be an inviting Platform for Commerce for new corporate facilities to move in and create jobs. It needs to provide Intelligent Infrastructure (redundant and resilient power and broadband connectivity) for mission critical and core business applications.

That’s how you build up tax revenues to pay for services. Increasing taxes and thinking you are going to make up shortfalls by creating Sheriff of Nottingham bloated traffic ticket fines only intimidates those who are paying taxes and they eventually seek relief by leaving the state. That goes for corporations as well as individuals.

Surrounding states are the ones benefiting from Illinois’ shortsightedness.

The “City that Works” seems to have become, “the City that Used to Work“. It’s time for radical reform. Chicago has to reverse its Vortex of Declining Mediocrity.

CARLINI-ISM : “It’s time to take a new approach in government. We cannot depend on 20th century solutions to solve 21st century challenges.”

Carlini’s visionary book, “Location, Location, Connectivity” will be coming out later this year.

Carlini’s visionary book, “Location, Location, Connectivity” will be coming out later this year.

He will be speaking at several upcoming conferences across the country later this year. He will be the keynote speaker at the HetNet Expo in Chicago on October 15th. Details at http://hetnetexpo.com/

Follow daily Carlini-isms at www.TWITTER.com/JAMESCARLINI

Copyright 2014 – James Carlini – ALL RIGHTS RESERVED

Watch this Video on A Better Way To Fight Harmful Free Radicals

Watch this Video on A Better Way To Fight Harmful Free Radicals

One response to “WHY CHICAGO AND ILLINOIS ARE FAILING: THE SHERIFF OF NOTTINGHAM MENTALITY”